The benefits of working for yourself include having control over your schedule and being your boss. It comes with money problems, too, like inconsistent income and trouble getting credit. Personal loans are one of the most important financial resources for independent contractors since they can be used to cover a range of obligations, from a personal loan emergency to business expenses.

In case you need a private advance loan while working for yourself, there are a few actions you can take to improve your chances of acceptance and favorable terms. These are some words of wisdom:

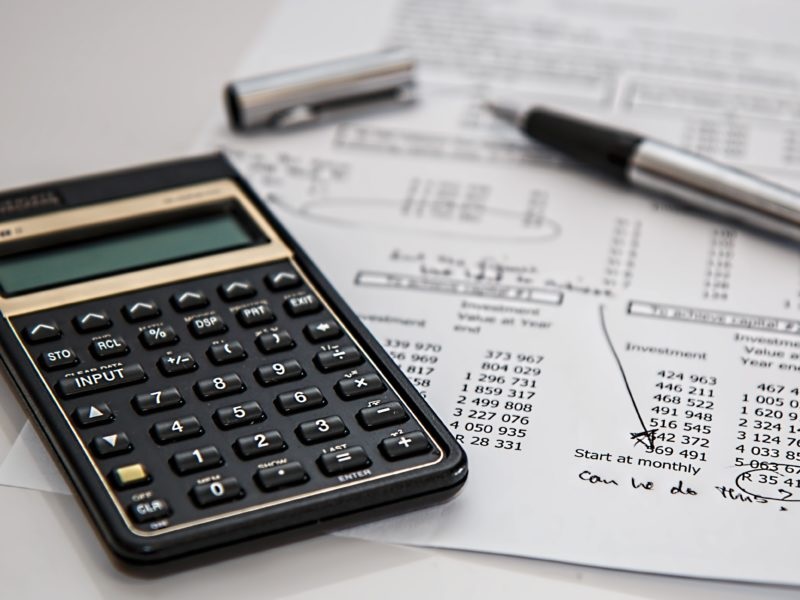

- Keep up good credit

One of the most crucial considerations for personal loans is your credit score. Loan approval and lenders require evidence of your past responsible borrowing and repayment practices. As a result, it’s critical to preserve good credit by paying your bills on time, ensuring that your credit card balances are low, and refraining from creating an excessive number of new accounts. With several internet sites, you can check your credit score for free. Take action to raise your credit score if it isn’t where you want it to be by paying off bills or disputing inaccuracies on your credit report.

- Get your documentation ready.

When applying for a personal loan or travel loan, you must submit proof of your income and other financial information. These could be tax returns, bank statements, and profit and loss statements if the person is self-employed. To fasten the application process and improve your chances of being accepted, compile all the required paperwork before submitting.

- Investigate various lenders

Lenders of many types, including banks, credit unions, and online lenders, provide personal loans. To locate the one that best meets your needs, compare your options because each has various requirements, interest rates, and repayment terms. Because they frequently offer a more lenient underwriting procedure and can be more ready to work with borrowers with non-traditional income sources, online lenders can be especially alluring to self-employed people.

- Think of a Co-Signer

Co-signing for a personal loan application could improve your chances of being approved if you have bad credit or a short credit history. A co-signer agrees to take on the risk of being unable to repay the salary loan, which increases the lender’s faith in your ability to repay the loan, which could lead to more human conditions.

- Develop Your Business Strategy in Advance

Be ready to present your business plan to the lender if you use a personal loan to finance an enterprise. This can aid the lender in comprehending your objectives, procedures, and expected revenue streams. If the lender observes this, it might also boost your chances of approval.

In conclusion, for self-employed people who need to finance a variety of expenses, personal loans and Indian loan app can be a useful instrument. You can improve your chances of getting authorized and receiving favorable conditions by maintaining solid credit, putting together your paperwork, looking into other lenders, contemplating a co-signer, and presenting your business plan.

Comments