When speaking regarding the capital, the fundamental area must be known in which the capital is primarily needed. Generally, the large fishes aren’t in lots of crisis nonetheless the actual problem emerges for the business entrepreneurs. Many of them have such great plans but getting less cash frequently produces the barrier for the intend to be effectively altered to the functionality. Since the continuous progression of the business plans being shut just for missing money, it had been quite based on tension for the economists.

Looking after your fact inside your ideas the small companies medicine backbone in the country’s economy, the federal government needed the choice in 1953 to produce an establishment that’s accountable to build up startups along with the existing business. The organization, known as Sba (Small business administration) needed a extended jump to help the companies while using the needed capital healthy in the loan.

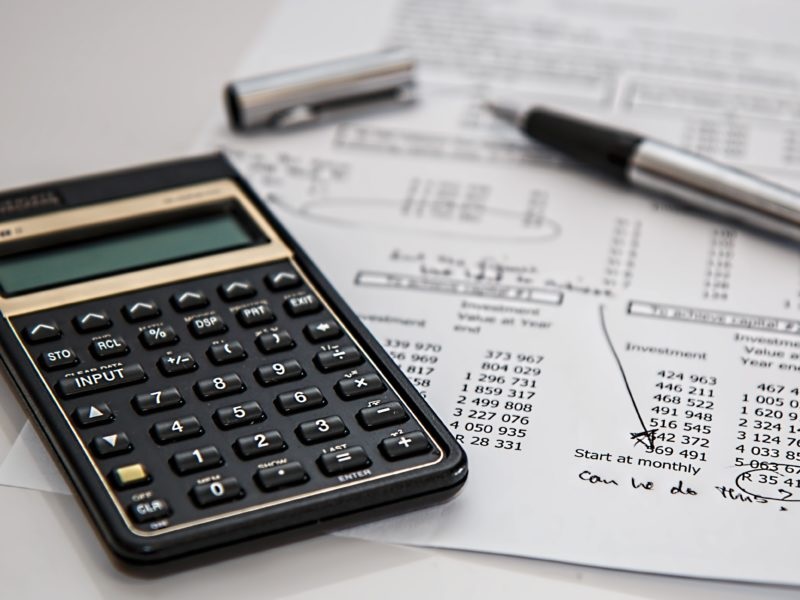

Using the government, Small business administration plays negligence the catalyst chilling out. Instead of loaning the money itself, Small business administration loan is essentially supplied by another lenders but SBA’s role within the lending may be the assurance along with the guarantor. When 50% in the quantity within the loan will most likely get offers for by Small business administration itself and 40% will get lenders, the little business possessors have to take out just 10% utilizing their pocket.

The problem may arise, why the Small business administration does not lend the cash alone, the clarification remains provided through the Small business administration. When the full amount could possibly get leant with the Small business administration, your expenditure in the organization increases enormously combined with the extra employees must also get compensated. Mainly there’s 2 types of loans which are proffered by Small business administration:

![]()

Small business administration 7(a):

Mainly produced for that small company, Small business administration 7(a) is considered because the popular loan service of Small business administration. While using the maximum loan size $5 million and 90% lower payment using the Small business administration along with the financial institution, users just create a payment of 10% because the lower payment. Coupled with fast closing time, this is among the most recognized services within the clientele.

Small business administration 504:

Designed for getting property and commercial characteristics, Small business administration has sketched an exact loaning service that’s named Small business administration 504. This excellent loan is called the very best plans which have been created.

Comments